In their classes, people will learn how investment works. Exion Edge welcomes everyone to register, whether they have a background in finance or not.

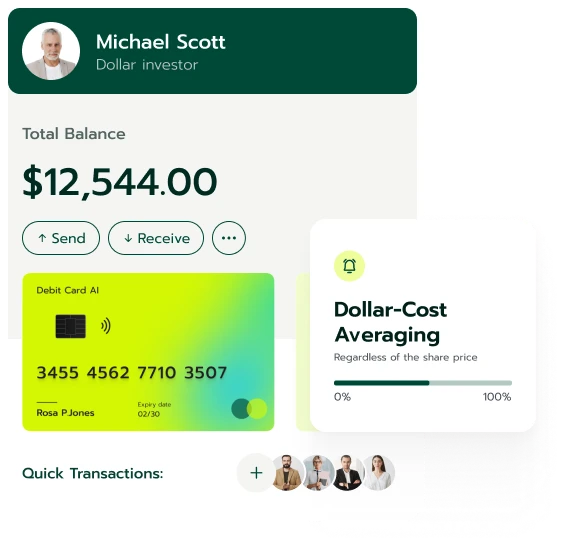

To connect with investment education companies, register for free on Exion Edge. Simply submit a name, email, and phone number in the sign-up form. Each registrant will get a call from the company Exion Edge matches them with for more information.

Exion Edge understands that investment education helps people become financially literate and vast. Hence, it encourages everyone to connect with investment education providers even if they have no background in any finance or business-related field. Connect with an investment education company on Exion Edge and begin learning.

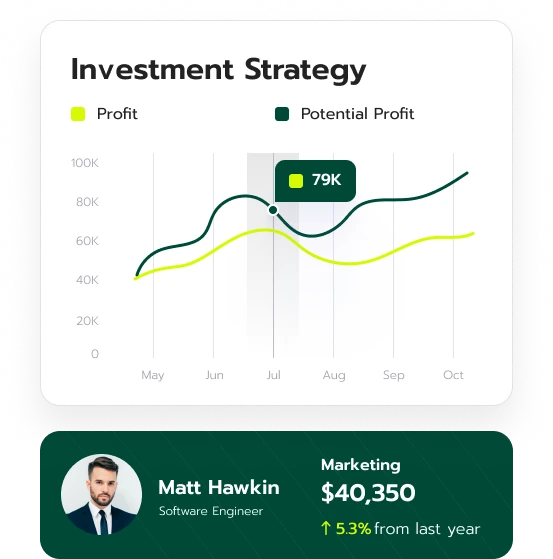

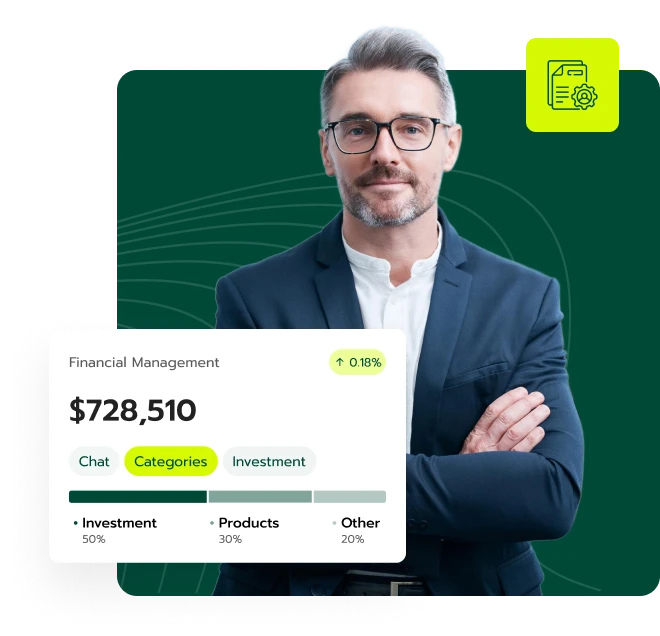

Striving to acquire hard and soft skills like fundamental analysis, problem-solving, or financial management? There is no need to look further, as Exion Edge can facilitate that.

As people enroll in investment education, they are exposed to real-life situations, the economy, and businesses and will acquire the skills to deal with them. Want to develop hard and soft skills? Register on Exion Edge.

Finding and connecting with investment education websites without help can be futile and frustrating.

So, Exion Edge seamlessly connects people to investment tutors for free. Looking to connect with an investment teacher, sign up on Exion Edge.

Exion Edge is not a trading website or institutional investor. It also does not connect people to financial markets or assets.

There’s no teaching on Exion Edge. The website only connects people to suitable education firms. Sign up for Exion Edge to connect with investment teachers.

Exion Edge is not an investment expert. Therefore, it does not advise people on the asset to buy or when to sell, for example.

Short-term investments include bond funds, money market accounts, treasury bills, mutual funds, and peer-to-peer lending. Long-term investments are real estate, pension plans, and ETFs (Exchange-Traded Funds).

Bond funds pool fixed-income securities. It allows diversification and may provide regular income. One downside is their high management fees.

Bond funds can be high-yield, municipal, multisector, international, and investment-grade. To learn more about these, register on Exion Edge.

These may pay a higher interest than other savings accounts. It is NCUA (National Credit Union Administration) and FDIC-insured (Federal Deposit Insurance Corporation). Yet, it requires a high minimum balance. Register and connect with investment education companies to learn more.

This is issued by the U.S. Treasury Department. It is often employed as an inflation hedge.

Certificate of Deposit

This savings account holds funds for a fixed period for interest.

Mutual Fund

This investment pools funds from different investors to buy various assets.

Commercial Paper

This unsecured debt instrument may finance short-term obligations.

Investors buy commercial papers from large corporations. They seek short-term maturity, high liquidity, and minimal risk. However, they have to deal with limited returns and credit risk. Types of commercial papers are checks, drafts, and promissory notes. Connect with investment tutors on Exion Edge for more information.

Investors can lend money directly (without an intermediary like credit unions, banks, or online lenders). Borrowers can spend the loan on small businesses, car purchases, and debt consolidation. Lenders accept fair credit scores and take a quick funding process but charge high interest. Register on Exion Edge to connect with investment education companies to know more about investments.

Unsecured loans are unprotected. Even when borrowers fail to pay, the lenders cannot seize their properties. Types of debt consolidation include credit cards, home equity, and student loans.

Burdened debtors may seek ease through various means. These include debt relief, bankruptcy, credit counseling, and debt settlement. Register on Exion Edge for more information.

Sometimes, an acquiring company can take over a company. It can do this through a proxy vote or by offering its (target company’s) shareholders a tender offer. In other words, it is when one company takes over another without the board of director’s consent.

Target companies do not just have to roll over. They can fight against hostile takeover using various strategies. These include the Pac-Man defense, supermajority amendment, crown jewel defense, golden parachute, poison pill, and greenmail. AOL's acquiring Time Warner, KKP’s leveraged buyout of RJR Nabisco, and Sanofi-Aventis’ acquisition of Genzyme are examples of hostile takeovers. Connect with investment teachers on Exion Edge to learn how target companies use these defenses.

This is an acquisition of a company by purchasing its shares gradually. This strategy is cheaper than others and allows shares to be purchased at market price to remove the need for premiums. In the U.S., it is used to get around the Williams Act Provisions. Register on Exion Edge to learn more.

In this case, the acquiring company becomes a subsidiary of the target company. The goal is to increase its edge in the market, such as brand recognition. To learn more about this method, register on Exion Edge.

This is when companies in the same/similar industry combine. This method increases diversification, increases market share, and reduces competition in the industry. Issues related to achieving a horizontal merger include bureaucratic controls and integration problems.

Companies in different stages of the supply chain for a product or service may combine. The pros include reduced operating costs and increased synergy. For more information, sign up on Exion Edge.

Then, the underwriter does after-market stabilization, and the company transitions to market competition. Thirty days is typically the time taken to assess an IPO. It is successful if there’s a 20% or less difference between market pricing and capitalization of the issuing company. Want to learn more? Register on Exion Edge.

In corporate finance, amalgamation combines two or more companies to form a larger company. This process takes different legal processes: acquisition with two survivors, amalgamation with survivors, and merger with one survivor. Learn about these processes by signing up on Exion Edge.

Companies amalgamate to access cheaper financing, eliminate competition, and access new markets, targets, and technologies. Sign up on Exion Edge to understand how companies achieve these through amalgamation.

This is the process a company uses to reduce its debt. It can do this by issuing equity, using excess cash from its operational activities, and selling its assets. A company can assess deleveraging using financial ratios, such as return on equity and debt-to-equity. For more details, register on Exion Edge.

These are equity or debt assets easily traded in the market. Learn more about public securities from investment educators by signing up on Exion Edge.

This asset is large enough to report to the IRS (Internal Revenue Service). Register on Exion Edge to learn from investment education companies.

Shareholders to reinvest their dividends in additional shares automatically. To find out more, register on Exion Edge.

It shows the amount paid as dividends relative to a company’s income. Exion Edge provides more insight into this.

This is the projection for a company’s annual dividend. Connect with investment tutors on Exion Edge to learn more.

This technique estimates the intrinsic value of a stock. Register on Exion Edge for more information.

| 🤖 Registration Fee | Zero cost to register |

| 💰 Administrative Fees | Fee-free service |

| 📋 Enrollment Ease | Simple, quick setup |

| 📊 Study Focus | Insights into Digital Currencies, Forex, and Investment Funds |

| 🌎 Country Availability | Available in nearly every country except the US |